Sunday, March 28, 2010

NY Times: Push to Eat Local Food Is Hampered by Shortage

Push to Eat Local Food Is Hampered by Shortage

By KATIE ZEZIMA

Published: March 26, 2010

EAST MONTPELIER, Vt. — Erica Zimmerman and her husband spent months pasture-raising pigs on their farm here, but when the time came to take them to slaughter, an overbooked facility canceled their appointment.

With the herd in prime condition, and the couple lacking food and space to keep them, they frantically called slaughterhouses throughout the state. After several days they found an opening, but their experience highlights a growing problem for small farmers here and across the nation: too few slaughterhouses to meet the growing demand for locally raised meat.

In what could be a major setback for America’s local-food movement, championed by so-called locavores, independent farmers around the country say they are forced to make slaughter appointments before animals are born and to drive hundreds of miles to facilities, adding to their costs and causing stress to livestock.

As a result, they are scaling back on plans to expand their farms because local processors cannot handle any more animals.

“It’s pretty clear there needs to be attention paid to this,” Agriculture Secretary Tom Vilsack said in an interview. “Particularly in the Northeast, where there is indeed a backlog and lengthy wait for slaughter facilities.”

According to the United States Department of Agriculture, the number of slaughterhouses nationwide declined to 809 in 2008 from 1,211 in 1992, while the number of small farmers has increased by 108,000 in the past five years.

Fewer slaughterhouses to process local meat means less of it in butcher shops, grocery stores and restaurants. Chefs throughout the Northeast are partnering with farms to add locally-raised meat to their menus, satisfying a customer demand. But it is not always easy.

more

Saturday, March 27, 2010

Bankling: The History of the Gold Standard: 25 Great Web Sites to Research Its Rise and Fall

The History of the Gold Standard: 25 Great Web Sites to Research Its Rise and Fall

The lecture is largely based on this article in particular By Lawrence H. Officer

Thursday, March 25, 2010

Economist's View: Stop Panicking.

Bill Easterly emails to ask what I think of this:

Stop panicking: Capitalism repeatedly recovers from financial crises, by William Easterly: I am just beginning to dive into the awesome book by Carmen Reinhart and Ken Rogoff, This Time is Different: Eight Centuries of Financial Folly. Along with great analysis, they have some wonderful pictures, evidence, and data. What I say here is my own take on it.

First, financial crises are remarkably common. Their Figure 5.1 shows the number of countries that have defaulted on their external debt (one possible dimension of a financial crisis) over the last two centuries. The numbers come in episodic waves of defaults and involve a remarkably high number of countries in each wave:

Second, the global capitalist system does well in the long run anyway. Average per capita income in the world (a shaky estimate, but probably right order of magnitude) increased by a multiple of 12 over 1800-2008, despite repeated epidemics of financial crises.

The US is arguably the country with democratic capitalism the longest, and it also shows a steady upward trend from 1870 to the present, despite repeated banking crises (using those identified by Reinhart and Rogoff), with usually little effect of each crisis on output relative to trend (except for the Great Depression).

Reinhart and Rogoff calculate directly the growth pattern before and after crises in advanced capitalist economies, and growth does indeed recover quickly to the trend growth rate of around 2 percent per capita per annum. 2 percent per capita is roughly the same growth rate that increased US per capita income so much from 1870 to the present.

y-axis reads "Real GDP Growth (Percent)"

I don’t mean to minimize the short run pain that the current financial crisis has caused. It’s horrible. But there is no reason to panic about the long run growth potential looking forward.

The obvious rejoinder is Keynes’ “in the long run, we are all dead.” But we can’t ignore that Capitalism already survived repeated financial crises and has made us all vastly better off despite them. So here’s a counter-quote: “In the long run, we are all better off because our dead ancestors stuck with capitalism.”

My take is a bit different. The graph of per capita income from 1870 - 2008 seems to say we shouldn't worry that aggressive intervention to stimulate the economy will cause long-run problems. It may help substantially in the short-run, but the graph above indicates it's unlikely to have long-run consequences. So, I agree, let's not panic. Let's not panic and start reducing stimulus measures too soon, or be too timid with stimulative policies, out of fear it might harm long-run growth. As the Great Depression shows us -- a time when there were legitimate fears about capitalism ending -- the more attention we pay to the short-run problems that undermine support for capitalism, the better chance there is that it will survive in the long-run.

I should acknowledge the Reinhart and Rogoff finding that debt levels higher than 90% of GDP are associated with lower economic growth:

...[D]ebt burdens are racing to thresholds of (roughly) 90 per cent of gross domestic product and above. That level has historically been associated with notably lower growth.

While the exact mechanism is not certain, we presume that at some point, interest rate premia react to unchecked deficits, forcing governments to tighten fiscal policy. Higher taxes have an especially deleterious effect on growth. ...

Given these risks of higher government debt, how quickly should governments exit from fiscal stimulus? This is not an easy task, especially given weak employment, which is again quite characteristic of the post-second world war financial crises... Given the likelihood of continued weak consumption growth in the US..., rapid withdrawal of stimulus could easily tilt the economy back into recession. Yet, the sooner politicians reconcile themselves to accepting adjustment, the lower the risks of truly paralysing debt problems down the road. ...

But as Rogoff notes elsewhere,

Monetary policy has done what it can to limit damage. Fiscal policy I would also give high marks to. We moved in the right direction in as timely a manner as possible.

I am not as willing to give fiscal policy high marks. We could have, and should have, done more to help the economy, and it certainly could have been more timely. As for fears more aggressive intervention will lower long-run growth, so long as we have the discipline to exit from these policies gracefully -- to pay the bill for the stimulus package in the good times -- long-run growth should not be affected by aggressive intervention in the short-run.

I believe that when the time comes to pay for the stimulus package, we'll do the right thing, just as we've always done in the past (yes, I know I'm being Pollyannish). And, in any case, the long-run debt problem has little to do with the stabilization measures used to counter the effects of the recession. The growth in health care costs is the problem in the long-run, nothing else matters much in comparison. If we fix the health cost escalation problem, a much more aggressive intervention to help the economy could have easily been absorbed into the budget without creating problems. And if we don't fix the health cost problem, the size of the stimulus package is of little consequence by comparison.

Finally, on the general "stop panicking" message, when people are hurting -- and they are -- we ought to panic. Legislators have given little indication that the understand the urgency of the employment problem we face. We need more panic, not less, about the employment situation.

Wednesday, March 24, 2010

Wednesday, March 17, 2010

Economist's View: Questions and Answers about the Financial Crisis

Gary Gorton

Link to full pdf (the full article is required reading for History of Intl Business and Finance)

Here is the beginning and end of a (much longer) Q&A with Gary Gorton discussing the financial crisis. He explains how the crisis was generated by a bank run much like past bank runs, but in a different type of asset and in a different segment of the banking system.

Rather than a run by individual depositors on demand deposits held in traditional banks (or, further in the past, private bank notes), this run involved firms and institutional investors and it was on repo held in the shadow banking system:

Questions and Answers about the Financial Crisis, Prepared for the U.S. Financial Crisis Inquiry Commission, by Gary Gorton[open link]: 1. Introduction ... Yes, we have been through this before, tragically many times. U.S. financial history is replete with banking crises and the predictable political responses. Most people are unaware of this history, which we are repeating. A basic point of this note is that there is a fundamental, structural, feature of banking, which if not guarded against leads to such crises. Banks create money, which allows the holder to withdraw cash on demand. The problem is not that we have banking; we need banks and banking. And we need this type of bank product. But, as the world grows and changes, this money feature of banking reappears in different forms. The current crisis, far from being unique, is another manifestation of this problem. The problem then is structural.

In this note, I pose and try to answer what I think are the most relevant questions about the crisis. I focus on the systemic crisis, not other attendant issues. I do not have all the answers by any means. But, I know enough to see that the level of public discourse is politically motivated and based on a lack of understanding, as it has been in the past, as the opening quotations indicate. The goal of this note is to help raise the level of discourse.

2. Questions and Answers

Q. What happened?

A. This question, though the most basic and fundamental of all, seems very difficult for most people to answer. They can point to the effects of the crisis, namely the failures of some large firms and the rescues of others. People can point to the amounts of money invested by the government in keeping some firms running. But they can’t explain what actually happened, what caused these firms to get into trouble. Where and how were losses actually realized? What actually happened? The remainder of this short note will address these questions. I start with an overview.

There was a banking panic, starting August 9, 2007. In a banking panic, depositors rush en masse to their banks and demand their money back. The banking system cannot possibly honor these demands because they have lent the money out or they are holding long-term bonds. To honor the demands of depositors, banks must sell assets. But only the Federal Reserve is large enough to be a significant buyer of assets.

Banking means creating short-term trading or transaction securities backed by longer term assets. Checking accounts (demand deposits) are the leading example of such securities. The fundamental business of banking creates a vulnerability to panic because the banks’ trading securities are short term and need not be renewed; depositors can withdraw their money. But, panic can be prevented with intelligent policies. What happened in August 2007 involved a different form of bank liability, one unfamiliar to regulators. Regulators and academics were not aware of the size or vulnerability of the new bank liabilities.

In fact, the bank liabilities that we will focus on are actually very old, but have not been quantitatively important historically. The liabilities of interest are sale and repurchase agreements, called the “repo” market. Before the crisis trillions of dollars were traded in the repo market. The market was a very liquid market like another very liquid market, the one where goods are exchanged for checks (demand deposits). Repo and checks are both forms of money. (This is not a controversial statement.) There have always been difficulties creating private money (like demand deposits) and this time around was no different.

The panic in 2007 was not observed by anyone other than those trading or otherwise involved in the capital markets because the repo market does not involve regular people, but firms and institutional investors. So, the panic in 2007 was not like the previous panics in American history (like the Panic of 1907, shown below, or that of 1837, 1857, 1873 and so on) in that it was not a mass run on banks by individual depositors, but instead was a run by firms and institutional investors on financial firms. The fact that the run was not observed by regulators, politicians, the media, or ordinary Americans has made the events particularly hard to understand. It has opened the door to spurious, superficial, and politically expedient “explanations” and demagoguery. ...

3. Summary

The important points are:

• As traditional banking became unprofitable in the 1980s, due to competition from, most importantly, money market mutual funds and junk bonds, securitization developed. Regulation Q that limited the interest rate on bank deposits was lifted, as well. Bank funding became much more expensive. Banks could no longer afford to hold passive cash flows on their balance sheets. Securitization is an efficient, cheaper, way to fund the traditional banking system. Securitization became sizable.

• The amount of money under management by institutional investors has grown enormously. These investors and non‐financial firms have a need for a short-term, safe, interest-earning, transaction account like demand deposits: repo. Repo also grew enormously, and came to use securitization as an important source of collateral.

• Repo is money. It was counted in M3 by the Federal Reserve System, until M3 was discontinued in 2006. But, like other privately-created bank money, it is vulnerable to a shock, which may cause depositors to rationally withdraw en masse, an event which the banking system – in this case the shadow banking system—cannot withstand alone. Forced by the withdrawals to sell assets, bond prices plummeted and firms failed or were bailed out with government money.

• In a bank panic, banks are forced to sell assets, which causes prices to go down, reflecting the large amounts being dumped on the market. Fire sales cause losses. The fundamentals of subprime were not bad enough by themselves to have created trillions in losses globally. The mechanism of the panic triggers the fire sales. As a matter of policy, such firm failures should not be caused by fire sales.

• The crisis was not a one-time, unique, event. The problem is structural. The explanation for the crisis lies in the structure of private transaction securities that are created by banks. This structure, while very important for the economy, is subject to periodic panics if there are shocks that cause concerns about counterparty default. There have been banking panics throughout U.S. history, with private bank notes, with demand deposits, and now with repo. The economy needs banks and banking. But bank liabilities have a vulnerability.

Update: See also What Really Went Wrong?, BY Steve Landsburg.

Thursday, March 4, 2010

The net fiscal expenditure stimulus in the US 2008-2009: Less than what you might think

The crisis led to significant fiscal stimulus efforts by the US government to offset the downturn. But this column argues that, properly adjusted for the declining fiscal expenditure of the fifty states, the aggregate stimulus was close to zero in 2009. While a net decline was avoided, the stimulus did not raise aggregate expenditure above its predicted mean. This can explain the anaemic reaction of the US economy to the alleged “big federal fiscal stimulus”.

Bailout packages have dominated political debate in the US and elsewhere. The global financial crisis led to a massive bailout of the US financial system and significant fiscal stimulus efforts by the US federal government to offset the resulting severe economic downturn. The sheer size of the federal commitments, at a time when the unemployment reached two digit figures, has led observers to question the efficacy of fiscal policy. Moreover, questions were raised with respect to the size of the fiscal multiplier in the US, as well as about possible adverse effects of higher future debt overhang (see de Resende et al. 2010, Barro and Redlick 2009, Spilimbergo et al. 2009 and the references therein).

Given that the counterfactual of the performance of the US economy in the absence of the fiscal stimulus is hard to ascertain, one may thus question its effectiveness, and hence the logic of continuing it. Before taking a position on these vexing issues, it is vital to ascertain the net size of the fiscal expenditure stimulus of the real sector. This issue is of key importance in a federal system like the US, where the fifty states are restrained from borrowing in recessions and frequently refrain from raising taxes at times of collapsing tax bases. While stabilising the financial system is useful in preventing bank runs, deepening credit constraints facing key sectors like local government expenditures imply that financial bailouts would not prevent, in the short-run, a sizable contraction of aggregate demand.

more

Two articles about the free market myth of Chile

Anyway, the Chilean earthquake has focused attention on Chile. Here are a couple of articles that refute Ferguson's story:

The Chicago boys and the Chilean earthquake

Did Milton Friedman's legacy save hundreds of thousands of lives?

By Andrew Leonard

The ghost of Milton Friedman, writes Bret Stephens in the Wall Street Journal, "was surely hovering protectively over Chile in the early morning hours of Saturday."

Thanks largely to him, the country has endured a tragedy that elsewhere would have been an apocalypse.

Stephens' logic is simple. After the U.S.-backed coup in 1973, in which Gen. Pinochet seized power from the democratically elected president Salvador Allende, a group of Chilean economists mentored by Friedman, and known to history as "the Chicago boys," instituted a series of radical free market reforms. Since that point, averaged over the decades, Chile has experienced the strongest sustained economic growth in South America. Rich countries, argues Stephens, are more likely to institute and enforce building codes. Q.E.D. Milton Friedman saved lives.

Some might find it intellectually provocative to cite Milton Friedman's authority in an argument that depends on the foundation of successfully enforced government-mandated building code regulations. The building inspector is not exactly a libertarian hero. Others might wonder if a more important factor in Chile's relatively tough building codes might be the devastating 9.5 earthquake the country endured in 1960. Haiti hadn't experienced an earthquake as bad as the one this January in 240 years. Earthquake resistant building codes tend to be taken more seriously in regions that are accustomed to regular bouts of annihilation.

But the earthquake is just a side show for the opinion page of the Wall Street Journal -- just another opportunity, however shameless, to push free market fundamentalism. One of the great blemishes on Milton Friedman's legacy is his association with the Pinochet government, which has been held responsible for murdering some 2, 000 to 3,000 people during its 17-year tenure, along with arresting tens of thousands of other citizens and enforcing harsh controls on the press and other civil liberties. Friedman's acolytes have long tried to wish away the complicity of the Chicago boys and their guiding light in one of the darkest chapters of modern Chilean history, but the stain is tough to get out. If trampling all over the democratically expressed wishes of the people and instituting an authoritarian reign of terror are what it takes to achieve economic growth, is it really worth it?

But a more pertinent question might be to ask just how much credit really is due Chicago-school economics for Chile's current relative prosperity? Mining alone accounts for 20 percent of Chile's GDP, and it is very much worth noting that the country's crown jewel, the copper industry, is completely dominated by one state-owned company, Codelco. Ponder that, for a second: Latin America's poster child for Chicago school economics features state control of the single most important economic resource. Huh.

Chile also suffers from some of worst income inequality in the world, and in fact, only began to take serious steps to address income disparities after the plebiscite that ended Pinochet's rule. And how did the government do that? By raising taxes and social spending.

But it's a job that's hardly finished, as evidenced by the reports of serious social disorder currently emanating from Chile, which some observers have compared unfavorably with Haiti.

Vast extremes in income equality do not make people happy, especially in the aftermath of huge disasters. That might be the true lesson of Chile, and it's one that the Chicago boys who make their home in the United States might do well to mull over.

Fantasies of the Chicago Boys

Paul Krugman

March 3, 2010, 8:07 am

Ah, Chile. Remember how, during the Social Security debate, Chile’s retirement system was held up as an ideal — except it turned out that it actually yielded very poor results for many people, and the Chileans themselves hated it? Now we have the usual suspects claiming that Chile’s relatively low death toll in the quake proves that — you guessed it — Milton Friedman was right. You see, the Chicago Boys made Chile rich, and that’s what did it.

As a number of people have pointed out, there’s this little matter of building codes. Friedman wasn’t exactly fond of such codes — see this interview in which he calls such codes a form of government spending, because they “impose costs that you might not privately want to engage in”.

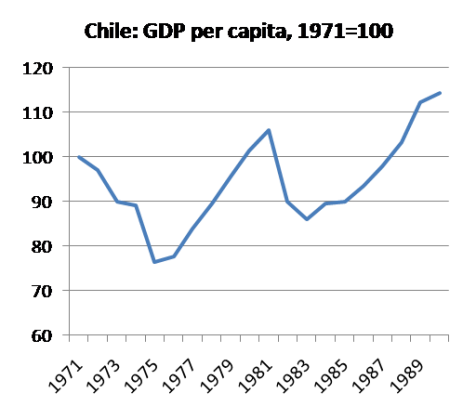

But there’s another point: the economics of Chile under Pinochet are a lot more ambiguous than legend has it. The way the story is told now, the free-market guys moved in, liberalized, and then there was a boom.

Actually, as you can see from the chart above, what happened was this: Chile had a huge economic crisis in the early 70s, which was, yes, partly due to Allende and the accompanying turmoil. Then the country experienced a recovery driven in large part by massive capital inflows, which mostly consisted of making up the lost ground. Then there was a huge crisis again in the early 1980s — part of the broader Latin debt crisis, but Chile was hit much worse than other major players. It wasn’t until the late 1980s, by which time the hard-line free-market policies had been considerably softened, that Chile finally moved definitively ahead of where it had been in the early 70s.

So: free-market policies are applied, and presto! prosperity follows — fifteen years later.

But remember, Obamanomics has definitely failed after 13 months.