Anyway, the Chilean earthquake has focused attention on Chile. Here are a couple of articles that refute Ferguson's story:

The Chicago boys and the Chilean earthquake

Did Milton Friedman's legacy save hundreds of thousands of lives?

By Andrew Leonard

The ghost of Milton Friedman, writes Bret Stephens in the Wall Street Journal, "was surely hovering protectively over Chile in the early morning hours of Saturday."

Thanks largely to him, the country has endured a tragedy that elsewhere would have been an apocalypse.

Stephens' logic is simple. After the U.S.-backed coup in 1973, in which Gen. Pinochet seized power from the democratically elected president Salvador Allende, a group of Chilean economists mentored by Friedman, and known to history as "the Chicago boys," instituted a series of radical free market reforms. Since that point, averaged over the decades, Chile has experienced the strongest sustained economic growth in South America. Rich countries, argues Stephens, are more likely to institute and enforce building codes. Q.E.D. Milton Friedman saved lives.

Some might find it intellectually provocative to cite Milton Friedman's authority in an argument that depends on the foundation of successfully enforced government-mandated building code regulations. The building inspector is not exactly a libertarian hero. Others might wonder if a more important factor in Chile's relatively tough building codes might be the devastating 9.5 earthquake the country endured in 1960. Haiti hadn't experienced an earthquake as bad as the one this January in 240 years. Earthquake resistant building codes tend to be taken more seriously in regions that are accustomed to regular bouts of annihilation.

But the earthquake is just a side show for the opinion page of the Wall Street Journal -- just another opportunity, however shameless, to push free market fundamentalism. One of the great blemishes on Milton Friedman's legacy is his association with the Pinochet government, which has been held responsible for murdering some 2, 000 to 3,000 people during its 17-year tenure, along with arresting tens of thousands of other citizens and enforcing harsh controls on the press and other civil liberties. Friedman's acolytes have long tried to wish away the complicity of the Chicago boys and their guiding light in one of the darkest chapters of modern Chilean history, but the stain is tough to get out. If trampling all over the democratically expressed wishes of the people and instituting an authoritarian reign of terror are what it takes to achieve economic growth, is it really worth it?

But a more pertinent question might be to ask just how much credit really is due Chicago-school economics for Chile's current relative prosperity? Mining alone accounts for 20 percent of Chile's GDP, and it is very much worth noting that the country's crown jewel, the copper industry, is completely dominated by one state-owned company, Codelco. Ponder that, for a second: Latin America's poster child for Chicago school economics features state control of the single most important economic resource. Huh.

Chile also suffers from some of worst income inequality in the world, and in fact, only began to take serious steps to address income disparities after the plebiscite that ended Pinochet's rule. And how did the government do that? By raising taxes and social spending.

But it's a job that's hardly finished, as evidenced by the reports of serious social disorder currently emanating from Chile, which some observers have compared unfavorably with Haiti.

Vast extremes in income equality do not make people happy, especially in the aftermath of huge disasters. That might be the true lesson of Chile, and it's one that the Chicago boys who make their home in the United States might do well to mull over.

Fantasies of the Chicago Boys

Paul Krugman

March 3, 2010, 8:07 am

Ah, Chile. Remember how, during the Social Security debate, Chile’s retirement system was held up as an ideal — except it turned out that it actually yielded very poor results for many people, and the Chileans themselves hated it? Now we have the usual suspects claiming that Chile’s relatively low death toll in the quake proves that — you guessed it — Milton Friedman was right. You see, the Chicago Boys made Chile rich, and that’s what did it.

As a number of people have pointed out, there’s this little matter of building codes. Friedman wasn’t exactly fond of such codes — see this interview in which he calls such codes a form of government spending, because they “impose costs that you might not privately want to engage in”.

But there’s another point: the economics of Chile under Pinochet are a lot more ambiguous than legend has it. The way the story is told now, the free-market guys moved in, liberalized, and then there was a boom.

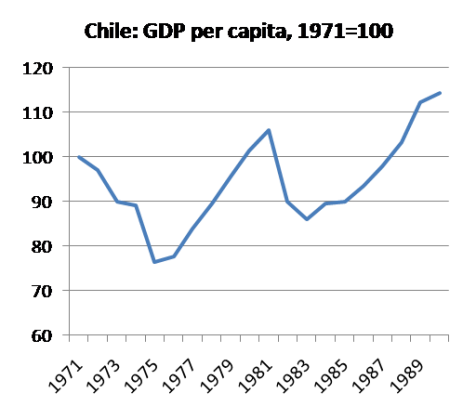

Actually, as you can see from the chart above, what happened was this: Chile had a huge economic crisis in the early 70s, which was, yes, partly due to Allende and the accompanying turmoil. Then the country experienced a recovery driven in large part by massive capital inflows, which mostly consisted of making up the lost ground. Then there was a huge crisis again in the early 1980s — part of the broader Latin debt crisis, but Chile was hit much worse than other major players. It wasn’t until the late 1980s, by which time the hard-line free-market policies had been considerably softened, that Chile finally moved definitively ahead of where it had been in the early 70s.

So: free-market policies are applied, and presto! prosperity follows — fifteen years later.

But remember, Obamanomics has definitely failed after 13 months.

No comments:

Post a Comment