In the interest of being fair, the most compelling arguments for blaming fannie and freddie come from Charles Calomiris:

Charles Calomiris onEconTalk October 26th, 2009

and the paper By Edward Pinto they reference:

www.aei.org/docLib/Pinto-High-LTV-Subprime-Alt-A.pdf

I think that Calomiris is right to point out that Krugman's claim (talked about in the last article posted) that Fannie and Freddie did not make subprime loans because they were legally prohibited doesn't hold water, but who knows.

Anyway, below are a couple of old blog posts, all by way of or from the Economist's View blog. The final post, directly from Economist's View is the best one.

Kroszner: CRA & the Mortgage Crisis

By Barry Ritholtz - December 3rd, 2008, 11:53AM

Sayeth the man:

“Some critics of the CRA contend that by encouraging banking institutions to help meet the credit needs of lower-income borrowers and areas, the law pushed banking institutions to undertake high-risk mortgage lending. We have not yet seen empirical evidence to support these claims, nor has it been our experience in implementing the law over the past 30 years that the CRA has contributed to the erosion of safe and sound lending practices. In the remainder of my remarks, I will discuss some of our experiences with the CRA. I will also discuss the findings of a recent analysis of mortgage-related data by Federal Reserve staff that runs counter to the charge that the CRA was at the root of, or otherwise contributed in any substantive way, to the current subprime crisis . . .

“This result undermines the assertion by critics of the potential for a substantial role for the CRA in the subprime crisis. In other words, the very small share of all higher-priced loan originations that can reasonably be attributed to the CRA makes it hard to imagine how this law could have contributed in any meaningful way to the current subprime crisis.”

Be sure to read the entire speech by the Fed Governor here. He discusses the result of an exhaustive data analysis performed by the various Fed Banks looking into the CRA issue and sub-prime

Of course, now that the election is over, the usual parade of reality challenged nitwits won’t be interested in any hard data or professional analyses. The full 233 page report is available here.

Things Everyone In Chicago Knows...

June 3, 2010

Which happen not to be true.It was deeply depressing to see Raguram Rajan write this:

The tsunami of money directed by a US Congress, worried about growing income inequality, towards expanding low income housing, joined with the flood of foreign capital inflows to remove any discipline on home loans.

That’s a claim that has been refuted over and over again. But what happens, I believe, is that in Chicago they don’t listen at all to what the unbelievers say and write; and so the fact that those libruls in Congress caused the bubble is just part of what everyone knows, even though it’s not true.

Just to repeat the basic facts here:

1. The Community Reinvestment Act of 1977 was irrelevant to the subprime boom, which was overwhelmingly driven by loan originators not subject to the Act.

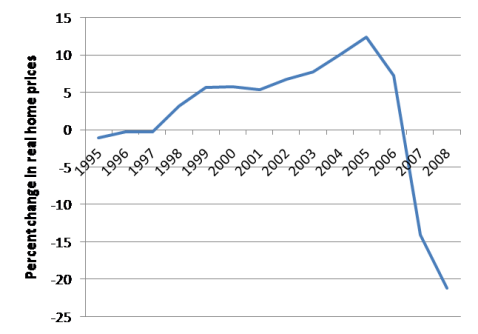

2. The housing bubble reached its point of maximum inflation in the middle years of the naughties:

Robert Shiller

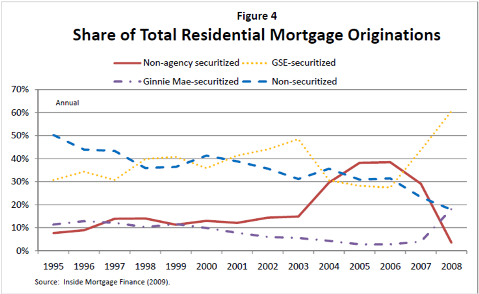

3. During those same years, Fannie and Freddie were sidelined by Congressional pressure, and saw a sharp drop in their share of securitization:

FCIC

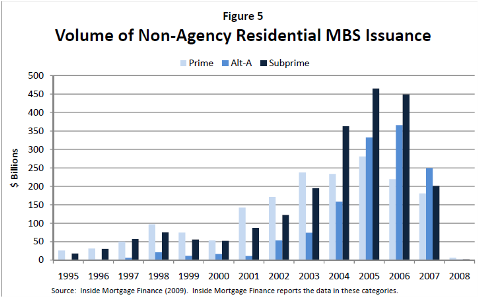

while securitization by private players surged:

FCIC

Of course, I imagine that this post, like everything else, will fail to penetrate the cone of silence. It’s convenient to believe that somehow, this is all Barney Frank’s fault; and so that belief will continue.

Once Again, It Wasn't Fannie and Freddie

Russ Roberts:

Krugman gets the facts wrong, by Russell Roberts: Back in July, as Fannie and Freddie were starting to implode, Krugman concluded that Fannie and Freddie weren't part of the subprime crisis:

But here’s the thing: Fannie and Freddie had nothing to do with the explosion of high-risk lending a few years ago, an explosion that dwarfed the S.& L. fiasco. In fact, Fannie and Freddie, after growing rapidly in the 1990s, largely faded from the scene during the height of the housing bubble.

Partly that’s because regulators, responding to accounting scandals at the companies, placed temporary restraints on both Fannie and Freddie that curtailed their lending just as housing prices were really taking off. Also, they didn’t do any subprime lending, because they can’t: the definition of a subprime loan is precisely a loan that doesn’t meet the requirement, imposed by law, that Fannie and Freddie buy only mortgages issued to borrowers who made substantial down payments and carefully documented their income.

So whatever bad incentives the implicit federal guarantee creates have been offset by the fact that Fannie and Freddie were and are tightly regulated with regard to the risks they can take. You could say that the Fannie-Freddie experience shows that regulation works.

His conclusion is quoted approvingly by Economist's View, a couple of days ago.

Alas, Krugman has his facts wrong. As the Washington Post has reported:

In 2004, as regulators warned that subprime lenders were saddling borrowers with mortgages they could not afford, the U.S. Department of Housing and Urban Development helped fuel more of that risky lending.

Eager to put more low-income and minority families into their own homes, the agency required that two government-chartered mortgage finance firms purchase far more "affordable" loans made to these borrowers. HUD stuck with an outdated policy that allowed Freddie Mac and Fannie Mae to count billions of dollars they invested in subprime loans as a public good that would foster affordable housing.

Housing experts and some congressional leaders now view those decisions as mistakes that contributed to an escalation of subprime lending that is roiling the U.S. economy.

The agency neglected to examine whether borrowers could make the payments on the loans that Freddie and Fannie classified as affordable. From 2004 to 2006, the two purchased $434 billion in securities backed by subprime loans, creating a market for more such lending.

$434 billion isn't zero, and that's just from 2004 to 2006.

I'm a bit confused about the part pointing to this blog. I don't quote that passage. In fact, I don't quote that column. In fact, I don't even link that column myself - it's only linked within a post from Jim Hamilton that I echo, and that's a post disagreeing with Krugman. So, saying I "quoted approvingly" is not exactly accurate.

The title of the post was "It Wasn't Fannie and Freddie." The point from Krugman I was referring to is (and yes, I do approve of it, and I'll explain why):

...I stand by my view that Fannie and Freddie aren’t the big story in this crisis.

Fannie and Freddie did not cause the credit crisis and nothing in the article quoted by Cafe Hayek, or anything since the article came out last June changes that.

There are two questions that are being confused in the debate over the source of the financial crisis:

1. What caused Fannie and Freddie to fail?

2. What caused the financial crisis?

Answering the first question does not necessarily answer the second. Showing that some politician, some policy, some legislation, lack of effective regulation, whatever, caused Fannie and Freddie to fail is important, we need to know why they were vulnerable when the system got in trouble, but Fannie and Freddie did not cause the crisis, they were a consequence of it.

How do we know this?

Fannie and Freddie became fairly large players in the subprime market, and they got that way by following the rest of the market down in lowering lending standards, etc. But they did not lead it down. Their actions came in response to a significant loss of market share, and it is this loss of market share that motivated them to take on more subprime loans.

We need to understand why the overall market - the part outside of Fannie and Freddie's domain - was able to lower lending standards (and increase their risk exposure in other ways as well), and how regulation which had worked up to that point failed to keep Fannie and Freddie from dutifully responding to the market pressures on behalf of shareholders by duplicating the strategy themselves, but again, they were followers, not leaders.

Tanta (via econbrowser) describes the downward plunge of the GSEs:

Fannie and Freddie .... didn't like losing their market share, and they pushed the envelope on credit quality as far as they could inside the constraints of their charter: they got into "near prime" programs (Fannie's "Expanded Approval," Freddie's "A Minus") that, at the bottom tier, were hard to distinguish from regular old "subprime" except-- again-- that they were overwhelmingly fixed-rate "non-toxic" loan structures. They got into "documentation relief" in a big way through their automated underwriting systems, offering "low doc" loans that had a few key differences from the really wretched "stated" and "NINA" crap of the last several years, but occasionally the line between the two was rather thin. Again, though, whatever they bought in the low-doc world was overwhelmingly fixed rate (or at least longer-term hybrid amortizing ARMs), lower-LTV, and, of course, back in the day, of "conforming" loan balance, which kept the worst of the outright fraudulent loans out of the pile. Lots of people lied about their income (with or without collusion by their lender) in order to borrow $500,000 to buy an overpriced house in a bubble market. They weren't borrowing $500,000 from the GSEs.

Michael Carliner continues, explaining how Fannie and Freddie took on the extra subprime debt:

Fannie and Freddie are ... subject to regulation by HUD under mandates to serve low- and moderate income households and neighborhoods. As originators and investors with more energy than brains expanded their (subprime) lending to those borrowers and neighborhoods, it was difficult for Fannie and Freddie to increase their shares. They didn't want to buy or guarantee subprime loans, correctly perceiving them to be insanely risky. Instead they purchased securities created by subprime lenders, taking only the supposedly-safe tranches. Those portfolio purchases were counted toward their obligations to lend to lower-income home buyers, but are now part of the write-downs.

Until Republicans started trying to claim that Fannie and Freddie caused the financial meltdown as a means of tying Obama to the crisis - a strategy that backfired badly when all of the embarrassing connections to Fannie and Freddie within the McCain campaign were revealed - nobody was saying Fannie and Freddie caused the crisis. Republicans simply worked backwards - they found connections between Democrats and Fannie and Freddie (never thinking to ask about their own connections), then tried to blame the crisis on Fannie and Freddie so as to make people think it was the Democrat's fault. And it's still going on despite the fact that the data doesn't support this story.

There is no excuse for the actions of the management of Fannie and Freddie, and I'm not trying to defend them or their choices, but the idea that Fannie and Freddie caused the general credit crisis is wrong.

Richard Green is dismissive of the whole notion:

Charles Calomiris and Peter Wallison blame Fannie Mae for the Subprime Mess:

Hmmmm. The loan performance on Fannie's book of business is substantially better than the overall mortgage market. And starting in 2002, Fannie Freddie (pink line) lost market share to ABS (light blue line). [The data underlying the graph is from the Federal Reserve, Table 1173. Mortgage Debt Outstanding by Type of Property and Holder.]

It wasn't Fannie and Freddie.

[Update: Follow-up argument: Barry Ritholtz: Fannie Mae and the Financial Crisis, What Caused the Financial Crisis?. For a recent academic paper at odds with the claim, see: It Wasn't Fannie and Freddie.]

No comments:

Post a Comment